Protection Layer - [ Distribution Shield ]

Near-Zero Market Impact Rewards Distribution System

In the dynamic landscape of cryptocurrency, managing token distribution without adversely affecting market prices is paramount. Our Near-Zero Market Impact Rewards Distribution System is meticulously designed to achieve this by leveraging advanced algorithmic trading strategies. This system ensures that the distribution of $iX tokens to our ecosystem participants is executed responsibly, maintaining market stability and fostering long-term growth.

Challenges with Traditional Rewards Distribution

Traditional token rewards distribution methods, such as those employed by $HNT, $IOTX, and $IO block rewards, often result in significant price impacts. These impacts arise due to the immediate sell pressure exerted on reward distribution dates, leading to potential volatility and diminished token value. Moreover, in existing rewards programs like infrastructure or agent incentives, rewards are typically claimed in stablecoins. Consequently, the sale of $O Coins in the open market can flood the market, further exacerbating price instability.

Our Solution: Responsible $iX Token Distribution

To address these challenges, we have developed a system where $iX tokens are sold in the open market using our proprietary quantitative systems, powered by iX LAB. This method ensures that each earned $iX token is sold over a period ranging from 16 to 42 days, effectively mitigating immediate sell pressure and minimizing market impact.

Key Features:

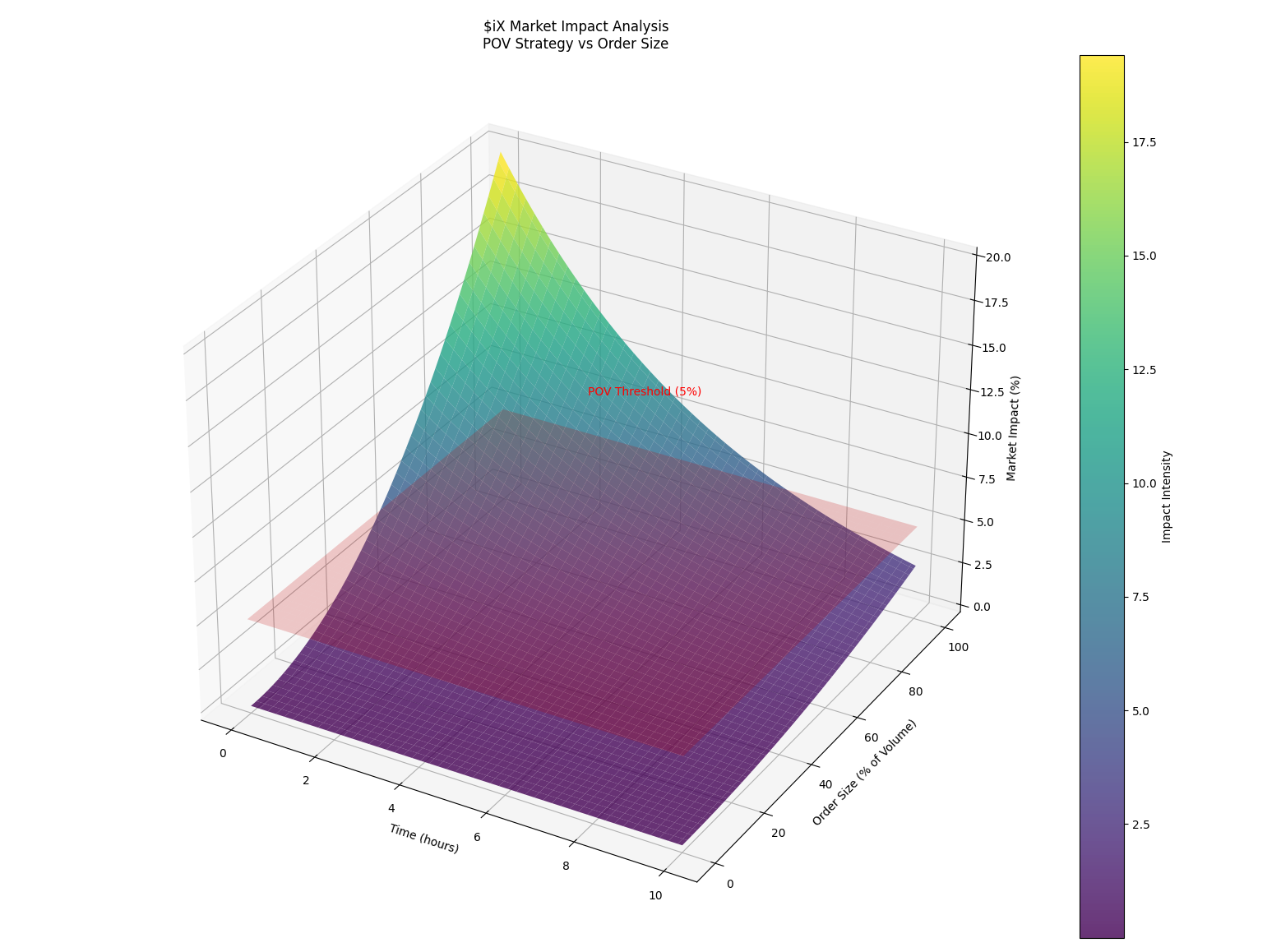

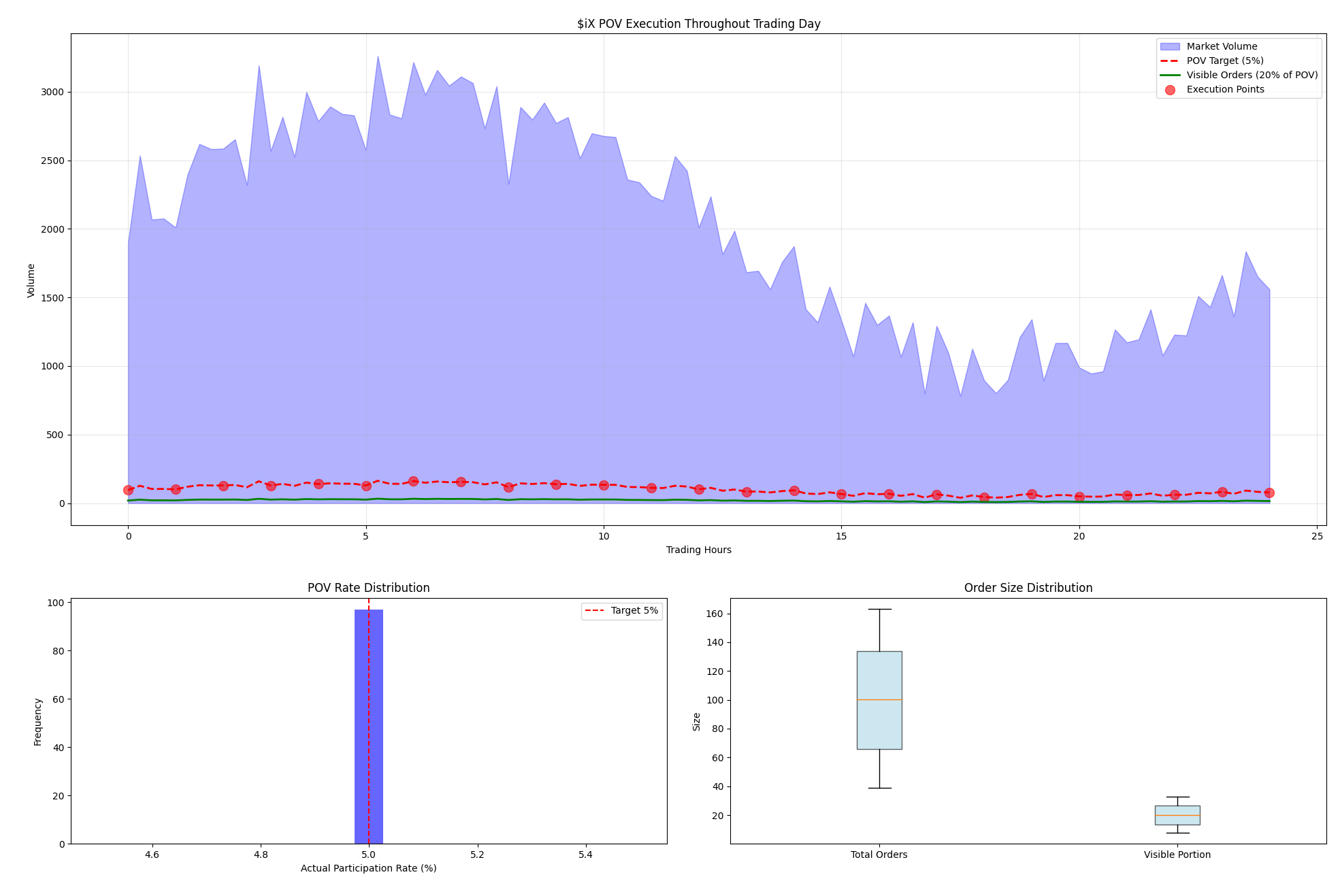

Controlled Sell Volume: Rewards earned by any pool are restricted to represent only 3-10% of the total sell volume in the market, preventing excessive market saturation.

Automated Treasury Operations: All company sell operations, including automated treasury sells, are capped at 10% of the market volume of the relevant trading pair, regardless of where it is listed.

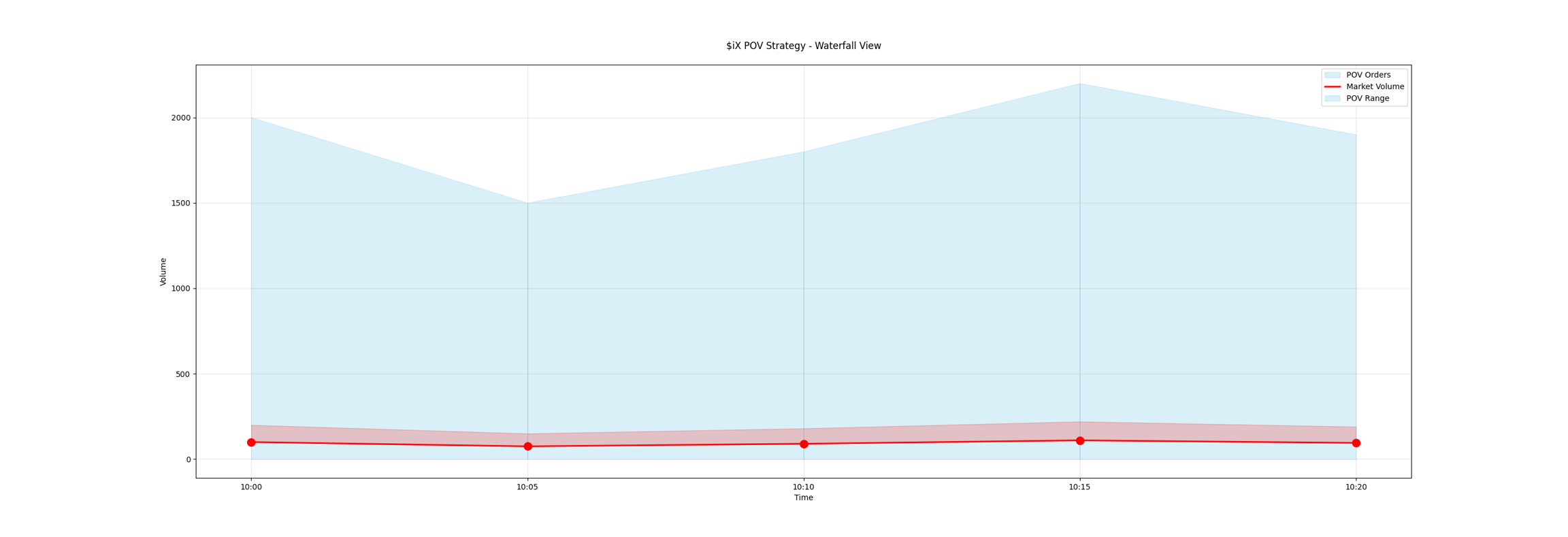

Percent of Volume (POV) Strategy: Our distribution strategy, known as the Percent of Volume (POV) Strategy, ensures disciplined and market-aligned token sales.

Understanding the Percent of Volume (POV) Strategy

The Percent of Volume (POV) Strategy is an algorithmic trading technique that targets a specific percentage of the total market volume over a designated period. This strategy is exceptionally effective for managing large orders within the crypto market, dynamically adjusting order sizes based on real-time or forecasted market volume.

Advantages Over Traditional Strategies:

Dynamic Adjustment: Unlike Time-Weighted Average Price (TWAP) or Volume-Weighted Average Price (VWAP) strategies, which follow rigid schedules, POV algorithms adapt in real-time to maintain a consistent participation rate.

Market Responsiveness: The strategy ensures that our trading activities remain proportionate to market activity, enhancing execution efficiency and reducing slippage.

Example Scenarios Illustrating the POV Strategy

To elucidate the effectiveness of the POV Strategy, consider the following scenarios:

Example 1: Steady Market Conditions

Interval

Market Volume ($iX)

POV Order Size (5%)

10:00 - 10:05

2,000

100

10:05 - 10:10

2,500

125

10:10 - 10:15

2,200

110

Example 2: Increasing Market Volume

Interval

Market Volume ($iX)

POV Order Size (5%)

11:00 - 11:05

3,000

150

11:05 - 11:10

4,000

200

11:10 - 11:15

5,000

250

Example 3: Decreasing Market Volume

Interval

Market Volume ($iX)

POV Order Size (5%)

12:00 - 12:05

2,500

125

12:05 - 12:10

2,000

100

12:10 - 12:15

1,500

75

Example 4: Volatile Market Conditions

Interval

Market Volume ($iX)

POV Order Size (5%)

13:00 - 13:05

4,000

200

13:05 - 13:10

2,000

100

13:10 - 13:15

3,500

175

Example 5: Extremely Low Volume

Interval

Market Volume ($iX)

POV Order Size (5%)

14:00 - 14:05

800

40

14:05 - 14:10

600

30

14:10 - 14:15

700

35

Key Takeaways from the Examples

Dynamic Adjustment: The POV Strategy facilitates real-time adjustments to order sizes based on current market volumes, preventing market saturation by large orders.

Consistent Market Participation: Maintaining a consistent participation rate ensures that our trading activities remain proportionate to overall market activity.

Minimized Market Impact: By spreading out sell orders over time and limiting them to a small fraction of market volume, the strategy significantly reduces the risk of causing substantial price disruptions.

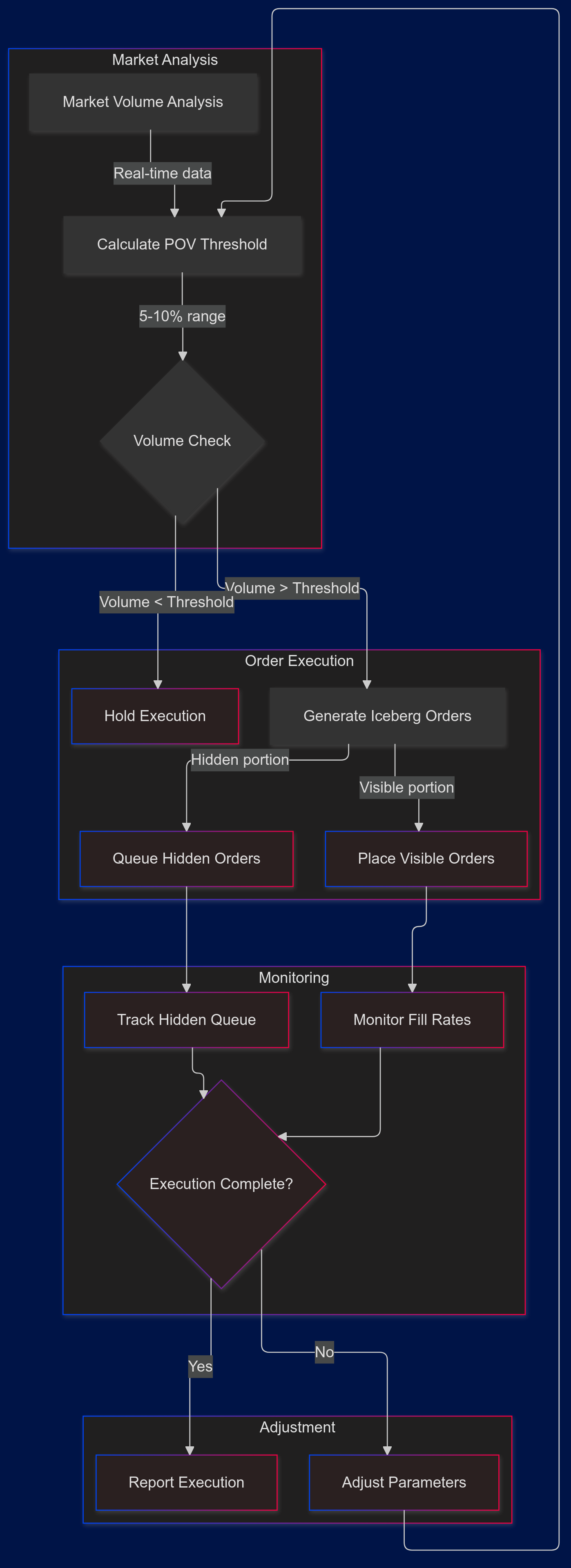

Incorporating Iceberg Orders into the System

To further enhance our Near-Zero Market Impact Rewards Distribution System, we integrate Iceberg Orders alongside the POV Strategy. Iceberg Orders are large orders divided into smaller limit orders, with only a fraction visible to the market at any given time. This integration ensures an additional layer of discretion and efficiency in our token distribution process.

Introduction to Iceberg Orders

Iceberg Orders help conceal the true size of large orders, preventing other market participants from reacting to or manipulating our trading activities. By displaying only a small portion of the total order, we maintain strategic execution without signaling our full selling intentions.

How Iceberg Orders Work

Visible Portion: A predefined small fraction of the total order is displayed in the order book. For instance, an order of $iX 1,000 might show only $iX 100.

Hidden Portion: The remaining $iX 900 is concealed. As the visible portion is filled, new limit orders are automatically placed to continue the execution until the entire $iX 1,000 order is completed.

Execution Process: This cyclical process ensures that the market perceives only a limited order size at any time, maintaining order confidentiality and minimizing market impact.

Integrating Iceberg Orders with the POV Strategy

Combining Iceberg Orders with the POV Strategy amplifies our ability to execute large sell orders discreetly and efficiently. This dual approach ensures that our token sales remain unobtrusive and aligned with market dynamics.

Key Benefits:

Enhanced Market Stability: Prevents large orders from overwhelming the market by limiting visible order sizes.

Reduced Visibility: Conceals the total order size, deterring other traders from adjusting their strategies in response.

Improved Execution Efficiency: Automates the replenishment of visible order portions, ensuring continuous participation without manual intervention.

Minimized Price Slippage: Reduces the likelihood of adverse price movements caused by large visible orders.

Example Scenarios Incorporating Iceberg Orders

Example 1: Steady Market Conditions with Iceberg Orders

Interval

Market Volume ($iX)

POV Order Size (5%)

Iceberg Order

10:00 - 10:05

2,000

100

Visible: 20, Hidden: 80

Execution:

Place an Iceberg Order of $iX 100 with $iX 20 visible.

As each $iX 20 is filled, another $iX 20 limit order is automatically placed until the total $iX 100 is sold.

Example 2: Increasing Market Volume with Iceberg Orders

Interval

Market Volume ($iX)

POV Order Size (5%)

Iceberg Order

11:00 - 11:05

3,000

150

Visible: 30, Hidden: 120

Execution:

Place an Iceberg Order of $iX 150 with $iX 30 visible.

The process repeats until the entire $iX 150 is executed.

Example 3: Volatile Market Conditions with Iceberg Orders

Interval

Market Volume ($iX)

POV Order Size (5%)

Iceberg Order

13:00 - 13:05

4,000

200

Visible: 40, Hidden: 160

Execution:

Place an Iceberg Order of $iX 200 with $iX 40 visible.

Orders are filled in $iX 40 increments until completion.

Operational Workflow

Determine POV Order Size:

Calculate 5-10% of the current market volume for the designated interval.

Set Iceberg Order Parameters:

Total Order Size: As determined by the POV Strategy.

Visible Portion: Typically 20-25% of the total order size.

Execute Order:

Place the Iceberg Order on the exchange with the defined parameters.

The system automatically replenishes the visible portion as it gets filled.

Monitor and Adjust:

Continuously monitor market conditions.

Adjust the visible portion or total order size as necessary to remain aligned with the POV Strategy.

Advantages of Combining POV Strategy with Iceberg Orders

Enhanced Market Stability: Reduces the likelihood of sudden price movements caused by large, visible orders.

Improved Execution Prices: Minimizes slippage by preventing other traders from reacting to large order sizes.

Confidentiality: Keeps our trading intentions discreet, protecting the strategy from being anticipated or countered by other market participants.

Automated Efficiency: Leverages technology to manage orders effectively without the need for constant manual oversight.

Applying This System to Rewards Distribution and Treasury Operations

Our integrated approach ensures that both rewards distribution and treasury sell operations are conducted responsibly and efficiently.

Rewards Conversion:

Gradual Sales: Earned $iX tokens are converted to stablecoins through gradual sales, adhering to POV limits.

Iceberg Orders: Utilized to conceal the total order size, maintaining discretion in our selling activities.

Treasury Operations:

Automated Sells: Treasury sell operations implement Iceberg Orders to break down large sells into smaller, less conspicuous orders.

Volume Capping: All sell operations are capped at 10% of the relevant market volume, preventing significant price drops.

Extended Sell Periods:

16 to 42 Days: Spread sell orders over an extended period to further minimize potential market impact, ensuring a seamless distribution of tokens into the market.

Conclusion

The Near-Zero Market Impact Rewards Distribution System embodies our commitment to responsible and strategic token management. By harnessing the synergy between the Percent of Volume (POV) Strategy and Iceberg Orders, we effectively minimize market impact, promote stability, and safeguard the value of the $iX token. This sophisticated approach not only benefits our ecosystem participants but also reinforces the long-term health and growth of the $iX market.

Key Takeaways

Strategic Execution: Combining POV and Iceberg Orders enables the discreet and efficient sale of tokens.

Market Confidence: These practices maintain investor confidence by preventing sudden market fluctuations due to large sell orders.

Responsible Management: Demonstrates our dedication to managing token supply responsibly for the benefit of all stakeholders.

Technological Advancement: Utilizes advanced algorithmic trading technologies to ensure optimal execution without manual intervention.

Sustained Market Health: Supports a healthy and stable market environment conducive to growth and long-term success.

Last updated