Protection Layer - [ Buffer Zone ]

Explanation (example)

Given this 30/70 split (30% to the quant worker, 70% to iX), here’s a refined approach to optimize buffer building while balancing immediate payouts and risk management:

Optimized Buffer Building Strategy

Initial Profit Split and Buffer Contribution:

Let’s allocate 30% of the quant worker’s earnings and 20% of iX LAB’s share towards building the buffer. This results in 50% of the total profit, ensuring a steady buffer growth without reducing payouts too drastically.

The quant worker, with a $10k profit, would retain 70% of 30% ($3k), but contribute $1.5k to the buffer from their share. Similarly, iX LAB would contribute $2k from their $7k share.

This approach pools resources while ensuring both parties have vested interest in the buffer’s growth and stability.

Scalable Buffer Target and Release Thresholds:

Target Buffer Size: Aim for a buffer equal to 5% of the total fund allocation, in this case, $5k for a $100k allocation. This smaller target allows the buffer to grow faster, protecting capital sooner and allowing earlier releases.

Once the buffer reaches this 5% target, reduce future buffer contributions to 20% of each side’s profit until a secondary target (such as 10%) is met. This lets profits flow more freely while still incrementally strengthening the buffer.

Milestone-Based Buffer Flexibility:

As the buffer grows, introduce milestone-based reductions in buffer contributions (e.g., at $5k and $10k). The buffer contribution percentage could scale down with each milestone met, effectively phasing out as the buffer grows stable.

iX LAB’s Supplemental Buffer Credit:

To incentivize quants who consistently keep their buffer intact, offer them buffer credit funded by iX LAB. This credit acts as a temporary extension to the buffer, giving additional trading capacity during high-volatility periods.

The buffer credit could be set to 1-2% of the fund allocation, usable only under certain performance conditions, and repayable from future profits before any new payouts.

Buffer Rewards for Long-Term Stability:

If a quant maintains a buffer for an extended period without drawdown (e.g., three consecutive months above the 5% buffer), award them with bonus payouts or minor allocation increases, strengthening loyalty and encouraging sound strategy.

Example Scenario for a $100k Allocation, $10k Profit:

Profit Split: $3k to the quant worker, $7k to iX LAB.

Buffer Contributions: 30% of the quant’s portion ($1.5k) + 20% of iX LAB’s portion ($2k) = $3.5k total for buffer growth.

Payout After Buffer:

Quant Worker: $1.5k after buffer contribution.

iX LAB: $5k after buffer contribution.

By structuring the buffer around smaller, milestone-driven targets, this approach maximizes payout flexibility while building a stable safety net over time. This hybrid model allows the buffer to scale with performance, minimizing risk while incentivizing long-term quant commitment and resilience.

Back-office & user POV Mechanism

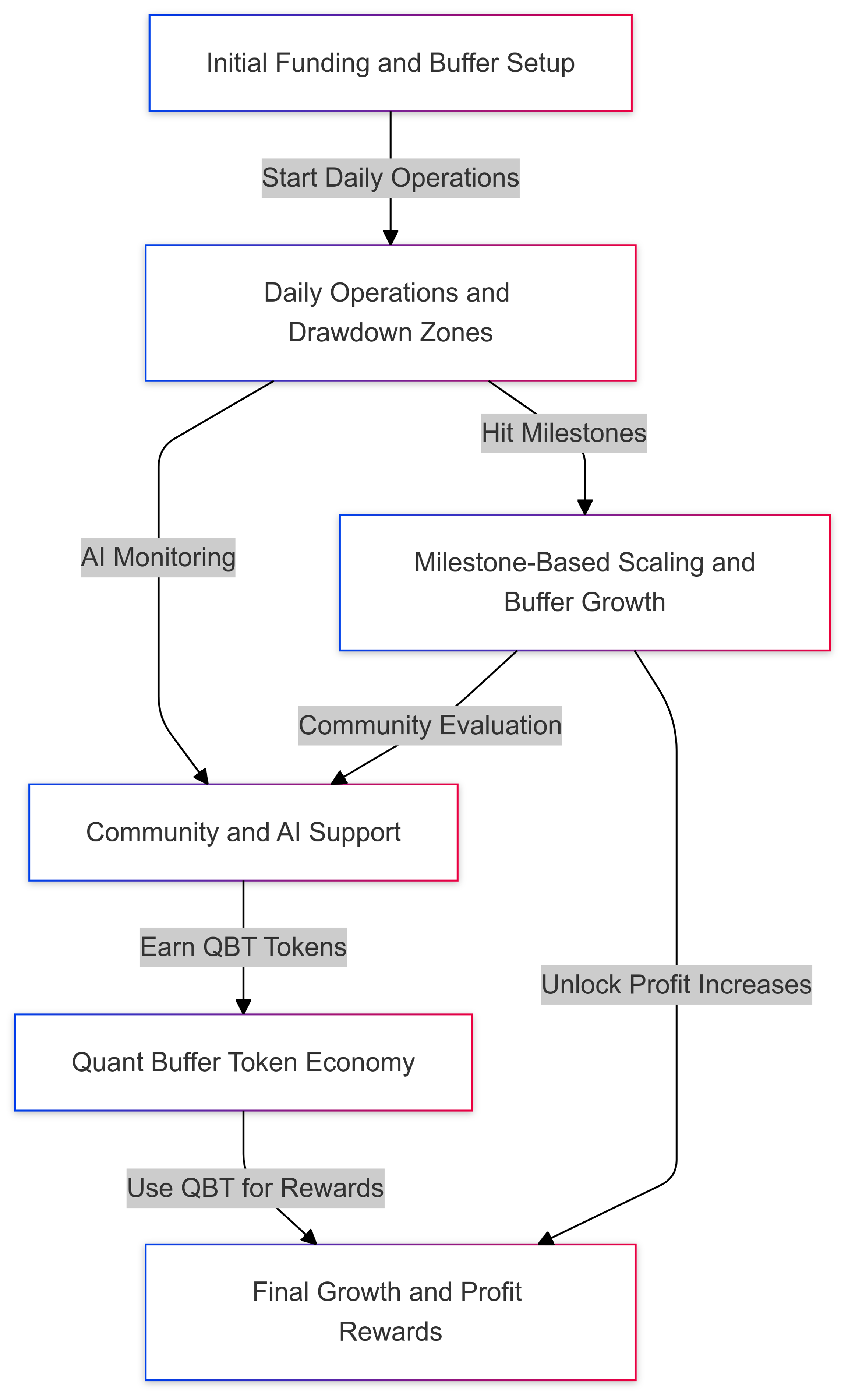

Here’s a comprehensive workflow from the quant worker’s perspective that integrates these buffer strategies into a seamless journey, from initial funding to long-term performance and growth. This flow is designed to help quant workers understand their path, maximize earnings, and manage risks effectively.

Quant Worker Workflow: Building & Managing Buffer Mechanism

1. Onboarding and Initial Funding

Evaluation and Initial Funding: After passing the evaluation stage, you receive an initial fund allocation (e.g., $100k) from iX LAB, along with risk parameters such as a daily soft drawdown limit, max drawdown, and buffer guidelines.

EDITH AI Orientation: You receive an introduction to EDITH AI, which will monitor your performance, assess risk, and adjust drawdown and buffer parameters in real-time.

2. Starting the Buffer Building Process

Profit Split and Initial Buffer Contributions: On your first profitable month:

30% of profits is credited to you.

70% of profits goes to iX LAB.

50% of total profit (split between you and iX LAB) is directed towards building your buffer. This initial buffer targets 5% of your fund allocation, creating a cushion as you grow your earnings.

3. Daily Operations with Buffer and Drawdown Management

Soft and Hard Drawdown Zones:

Soft Daily Drawdown: If you reach the daily drawdown limit, EDITH halts trading for the day to safeguard capital but resets it the next day, allowing you to continue operating with minimal restrictions.

Max Drawdown as the Ultimate Buffer: The max drawdown threshold (derived from your buffer size) represents your account’s safety net. If reached, trading will pause, and iX LAB will assess your buffer utilization.

Real-Time AI Adjustments: EDITH dynamically adjusts drawdown limits based on market volatility. In highly volatile periods, it may tighten daily limits, while in stable periods, it may allow more flexibility, helping you optimize performance and buffer growth.

4. Performance-Based Buffer Scaling & Rewards

Milestone-Based Contributions:

Once your buffer reaches 5% of your allocation, the contribution rate scales down. For example, buffer contributions may reduce from 50% of profits to 20%, allowing you more cash flow.

If you reach 10% buffer, contributions are further reduced, giving you even more flexibility and larger potential payouts.

Buffer Rebate Incentive: Maintaining your buffer above the target without hitting drawdowns over a sustained period (e.g., three months) earns you a Buffer Rebate. A portion of past buffer contributions (e.g., 20%) is returned as a bonus payout, rewarding you for consistent performance.

5. Accessing Community Support & Buffer Expansion

DAO-Driven Buffer Matching: With a strong track record, you may qualify for community buffer matching. The iX LAB community votes to match your buffer contributions, doubling your buffer support as a reward for stability.

Reputation-Based Buffer Loans: High-performing quants can request buffer loans from iX LAB’s community pool during temporary drawdowns, which are repaid with future profits. This gives you flexibility and extra support from iX LAB’s decentralized community.

6. Building the Quant Buffer Token (QBT) Pool

Earning QBT Tokens: For maintaining buffer levels and consistent growth, you earn Quant Buffer Tokens (QBT). These tokens represent your track record of stability and can be staked to unlock additional buffer limits or traded within iX LAB’s network.

Trading and Lending QBT: QBT tokens can be exchanged with other quants facing temporary drawdowns, creating a community-driven risk management system. High-performing quants can loan QBTs to others, earning additional income while supporting the ecosystem.

7. Achieving Performance Milestones and Scaling Up

Milestone-Based Buffer and Fund Scaling:

Upon reaching milestones (e.g., $10k, $20k in cumulative profits), your buffer requirements automatically scale down, and a portion of your buffer is released for payout.

EDITH AI may recommend higher fund allocations for consistently high performance, automatically increasing your trading capital by 10-20% after each milestone.

Profit Share Increases: For reaching long-term milestones without hitting max drawdowns, iX LAB may increase your profit share (e.g., from 30% to 32-35%) as an added reward for disciplined management.

8. Reflexive Learning and Strategy Adjustments with EDITH AI

Strategy-Driven Buffer Adjustments: If you adjust your trading strategy, EDITH recalibrates your buffer based on the associated risk, helping you align your trading style with iX LAB’s risk tolerance.

Real-Time Monitoring and Alerts: EDITH provides insights and early alerts if your buffer approaches the soft or hard drawdown zones, allowing you to make proactive adjustments and protect your position.

9. Leveraging the Buffer System for Growth

Co-Investment Options for Buffer Growth: You may choose to reinvest part of your profits into the buffer. For every dollar you contribute, iX LAB matches with a 50% contribution, helping you reach buffer targets faster and unlocking access to higher fund allocations.

Buffer Loan Access During High-Volatility Events: EDITH may recommend buffer loan activation during high-volatility events, temporarily extending your buffer limit to absorb unusual market conditions. This loan is automatically repaid from future profits, allowing you to navigate volatility safely.

Summary: Quant Worker Journey Through iX LAB’s Advanced Buffer System

This workflow establishes a resilient, performance-driven system where quants:

Build an initial buffer with shared contributions.

Gain flexibility through soft and hard drawdown zones.

Scale buffer contributions dynamically based on milestones.

Access community-driven support and buffer loans when needed.

Earn rewards and reputation-based benefits as they grow.

Through this mechanism, iX LAB empowers quant workers to manage risk, achieve growth milestones, and leverage community support—all while maintaining a robust, adaptable buffer that fosters long-term success in the decentralized quant hedge fund.

Advanced summary :

This workflow is designed as an interconnected system where each element builds on and supports the others, creating a cohesive buffer management framework. Here's how each component interrelates:

Initial Buffer Building is foundational, setting up a cushion from both quant and iX LAB contributions. This links to:

Milestone-Based Scaling and Contribution Adjustments: As the buffer grows, contribution requirements adjust, creating a natural progression for the quant.

Soft and Hard Drawdown Zones serve as safety mechanisms during trading and are reinforced by:

Real-Time AI Adjustments with EDITH: EDITH actively manages the drawdown thresholds, providing flexibility during high volatility or tightening risk controls as needed.

Performance-Based Rewards and Rebate Incentives: Staying within the buffer and avoiding hard drawdown allows quants to unlock rebates and additional flexibility, reinforcing risk management.

Community Support Mechanisms (DAO-Driven Buffer Matching and Buffer Loans) are integral to the decentralized model and enhance risk management by:

Allowing quants to tap into support when nearing buffer limits.

Rewarding stability, as high-reputation quants can receive support from the community, directly tying performance to community trust and rewards.

Quant Buffer Tokens (QBT) create an internal economy that:

Connects with Buffer Growth and Milestone Scaling by allowing quants to trade or stake QBT for additional buffer flexibility, creating a support network within iX LAB.

Incentivizes consistent buffer management, as tokens serve both as rewards and tools for maintaining safety.

Reflexive Learning with EDITH enhances adaptability by:

Linking to buffer recalibration as quants adjust strategies, ensuring buffer requirements match each trading style.

Providing real-time alerts and insights, helping quants proactively avoid buffer depletion.

Co-Investment and Buffer Loans During High Volatility are optional layers that:

Allow quants to scale up buffer contributions voluntarily for faster growth, tying directly into fund scaling and milestone-based buffer relaxation.

Activate temporary buffer extensions, providing flexibility in extreme conditions and ensuring long-term stability in the system.

Last updated